Broker Dealer

Asset classes

We are available, we are transparent and we offer an extensive product range that we are constantly uplifting in response to market appetites for different instruments.

FX and Metals CFDs

Our extensive Prime Broker relationships with Tier 1 investment banks gives us the capacity to curate bespoke liquidity solutions.

Our relationships with an array of Tier 1 investment banks including, JP Morgan, Natwest, Standard Chartered, and Macquarie, provides significant capacity to curate bespoke liquidity solutions that draw on superior access to more than twenty bank, non-bank and ECN liquidity providers.

Why work with us?

Low latency pricing

With trading servers in LD4, NY4 and TY3, and liquidity aggregated from locally connected LPs in each data centre, we are committed to delivering low latency pricing in FX and Metals, no matter where you choose to locate your infrastructure.

Highly competitive pricing

We understand that tight and stable spreads are vital for broker dealers and that this should not come at the cost of deep and executable liquidity.

We focus on tailored liquidity solutions with active price curation to provide an optimal trading environment.

Multi-stream flexibility

Multiple APIs with unique liquidity ensure optimal alignment of flow and pricing for broker dealers who receive varied flow profiles from their clients.

Execution quality

Access in-depth analysis and execution data, not only from our own proprietary systems but also backed by independent vendor software.

Explore our Broker Dealer solutions

After winning FX Markets Asia Best Prime of Prime for 2023, the judges commented on our customer focus, noting that we stood out from the competition, providing more innovative, diverse services.

Equity Index and Commodity CFDs

Our in-house quantitative pricing team have developed 34 proprietary Index and Commodity CFDs to specifically cater for the unique demands of the institutional API market.

These can be delivered as a bespoke solution to meet your liquidity needs. This includes a variety of competitive pricing options across both fixed and variable spread methodologies.

All 26 Degrees Index and Commodity CFDs are covered by our robust market data agreements providing full exchange coverage.

Why work with us?

Institutional liquidity

We deliver robust and transparent institutional liquidity which has been built in-house specifically for the institutional API market.

Flexible pricing structures

Highly competitive fixed or variable spread options help you get the edge.

Fast and resilient

Our network routes are optimised to deliver low latency pricing and execution for the most popular Index and Commodity CFDs. We take speed seriously and our price is backed by multi-site, multi-vendor redundancies.

Full market data coverage

Our comprehensive market data agreement provides full exchange coverage as well as a volume rebate that can allow us to waive market data fees for all Index and Commodity CFD products.

Explore our Broker Dealer solutions

After winning FX Markets Asia Best Prime of Prime for 2023, the judges commented on our customer focus, noting that we stood out from the competition, providing more innovative, diverse services.Equity and ETF CFDs

Leveraged long/short access

Our exclusive industry partnerships and deep prime brokering relationships give us unprecedented access to stock borrow globally.

Global exchange access

Access to over 35 exchanges across North America, Pan-Europe and APAC with extensive access to borrow, support for fractional equity CFDs and competitive financing.

Market Data available via API

Get a market data package for equities that is both broad and cost effective, allowing maximum scalability for our broker dealer clients.

Explore our Broker Dealer solutions

After winning FX Markets Asia Best Prime of Prime for 2023, the judges commented on our customer focus, noting that we stood out from the competition, providing more innovative, diverse services.

Algo execution

If your dealing desk is looking to enter or exit equities and manage risk quickly and efficiently 24/5, we offer a suite of Algos that include VWAP, TWAP, Iceberg, target percentage of market volume, smart order routing, and others.

Our Algos can also add value to your dealing desks by streamlining workflows and achieving outstanding executions.

Explore our Broker Dealer solutions

After winning FX Markets Asia Best Prime of Prime for 2023, the judges commented on our customer focus, noting that we stood out from the competition, providing more innovative, diverse services.

Tier 1 Prime Broker relationships supporting three and four way give-ups

Industry leading, but don’t just

take our word for it...

We are active in ASX small cap stocks, so we value the excellent attention by 26 Degrees to this end of the stock market."

Insights

Latest insights from

26 Degrees

Expert Voices

Expert Voices

Investing in US Securities? Something is stalking you …

26 Degrees' Chief Executive Officer, Gavin White ponders the upcoming changes to settlement cycles for US securities from T+2 to T+1.What does this mean for institutions trading US securities and how is 26 Degrees well positioned as an Australian headquartered company to help deal with this dread?

Expert Voices

Expert Voices

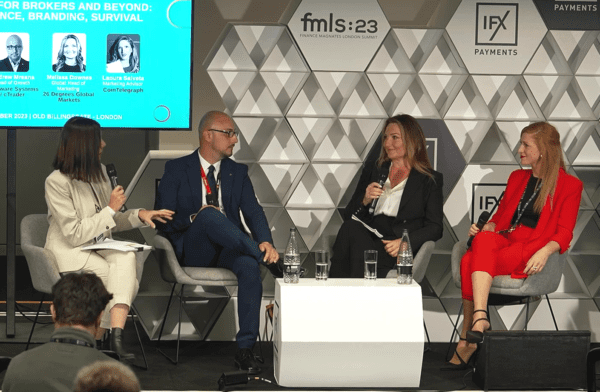

26 Degrees talks CySEC licence, infrastructure, liquidity stress

26 Degrees executives spoke with FinanceFeeds Editor-in-Chief Nikolai Isayev about the continued expansion in the EMEA region as the Prime of Prime Broker’s subsidiary now holds a CySEC license and is powered by oneZero’s trading technology.